Around 20 viable opportunities could boost financial inclusion while generating 10 billion dinars of gross income for financial institutions in Tunisia

The financial inclusion rate in Tunisia appears to have increased over the past years despite the country’s political and economic situation. This is evidenced by the results of the survey conducted in 2021 by Matine Consulting on behalf of the International Finance Corporation (IFC) covering about 1,100 individuals, 2,000 companies, 600 farmers and 400 Tunisians living abroad. For instance, this survey revealed an increase in the rate of individuals customers of a formal financial institution to 75% in 2021, compared to 61% in 2018.

However, the survey revealed disparities in terms of financial inclusion according to the segment, income and geographical location. Indeed, 9% of individuals and 29% of businesses have no access to financial services. The level of use of these services is basic for 40% of individuals and 51% of businesses. Low-income individuals, self-employed people and very small businesses represent the categories least included financially. Regions outside the major economic hubs in the east of the country – notably Greater Tunis, Sousse, Sfax and Nabeul – also seem to be disadvantaged.

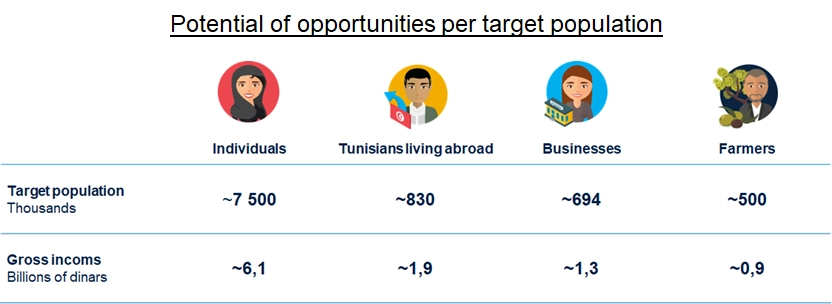

The results of these surveys and the analyses carried out have identified a series of opportunities available to market participants. Seizing these opportunities would help reduce disparities and contribute to the development of financial inclusion for the benefit of 7.5 million individuals, 694,000 formal businesses, 500,000 farmers and 800,000 Tunisians Resident Abroad, while generating nearly 10.3 billion dinars ($3.2 billion) in gross income for market participants. These opportunities come mainly from account access services, digital payments and transfers, financing, insurance and non-financial services.

In order to reach the full potential of the Tunisian market, market participants would benefit from tailoring their offerings to the specific needs of individuals and businesses with limited financial access and use. The development of the use of digital channels and the digitalization of services and processes would allow financial institutions and other market players to reduce their distribution and operating costs and consequently give them more room to reduce their pricing.

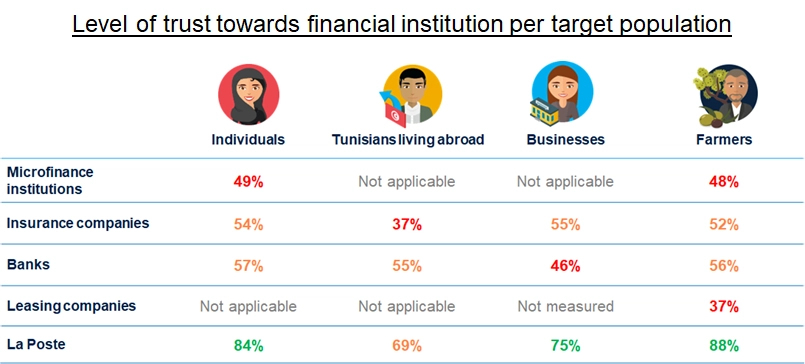

Similarly, increased communication and awareness-raising efforts would contribute to improving the level of financial literacy and reducing the overall trust deficit. Establishing partnerships between market players would also help to stimulate cross-selling and thus allow financial institutions to reach new market segments.

Effective coordination between the various public and private players is also essential. Although the Central Bank of Tunisia and the Ministry of Finance have launched several initiatives in recent years, additional efforts are needed to improve the governance of financial inclusion through close coordination among stakeholders. It is also a question of accelerating the reforms underway and relaxing certain regulatory constraints to encourage the emergence of new disruptive players. The combination of all these efforts would boost financial inclusion, provide more opportunities for market players, and thus strengthen the Tunisian economy.